Exploring Insurance Services: The Way They Protect Your Life and Well-Being

Insurance coverage is vital in providing financial security against unexpected events. Insurance covers many categories, such as health, auto, and homeowners insurance, designed to handle specific risks. Knowing how these services function is essential for individuals aiming to safeguard their assets and well-being. As individuals navigate the complexities of insurance, they may begin to wonder what coverage is ideal for their specific situation. The answers could greatly impact their future security and stability.

Learning About Different Insurance Categories

While most people understand insurance is important, knowing the various types can be a challenge. Insurance is a broad field that includes many categories, each designed to address specific needs. For example, health insurance, covers medical expenses, offering people access to healthcare services. Car insurance protects against monetary loss in the event of vehicle accidents or theft. Homeowners coverage safeguards property against damage or loss caused by events like fire or theft. Life insurance provides financial assistance to beneficiaries after the policyholder dies, ensuring their loved ones are cared for. Additionally, there are specialized types such as disability insurance, which provides income replacement if an individual cannot work due to injury or illness. Each category has a distinct function, highlighting the importance of evaluating personal needs to pick the best coverage. Knowing these distinctions is vital for making smart decisions about coverage options.

Insurance Operations: The Fundamentals

To grasp how insurance functions, one must understand the core principle of risk mitigation. Insurance functions based on the idea of sharing risk among many people. When a person purchases an insurance policy, they must pay a premium in exchange for protection against potential financial losses. This system permits carriers to collect funds from a large pool of insured individuals, building up capital to pay out claims made by those who experience losses.

The process begins when individuals assess their individual exposures and select appropriate coverage options. Insurance providers next assess these potential hazards, determining premiums using criteria like health, age, and personal habits. Through the sharing of financial risk among many participants, coverage reduces the effect of sudden occurrences like accidents, illnesses, or natural disasters. Finally, this structure gives clients a sense of security, certain they have a backup plan in place should unforeseen circumstances arise.

The Value of Being Insured

Being insured delivers a multitude of upsides that substantially improve peace of mind and economic safety. A key advantage is the security it delivers against unexpected financial burdens, for instance, damage to property or healthcare costs. This protection enables people to handle hazards better, certain they have aid in times of need. Furthermore, insurance protection helps grant the ability to use vital services, like health services, that would otherwise be too costly.

In addition, being insured promotes stability and reliability in one's life, allowing people to concentrate on objectives free from the perpetual concern about possible economic difficulties. Coverage may also boost financial reputation, because financial institutions frequently regard people who are insured more positively. Overall, insurance serves as a critical tool for handling potential hazards, promoting resilience and confidence in facing life's uncertainties and securing holistic health.

Choosing the Right Insurance for Your Needs

How should clients approach the intricate realm of insurance options to find the coverage that best suits their unique circumstances? First, they should assess their specific needs, taking into account elements like family size, health conditions, and financial obligations. This evaluation helps narrow down the necessary forms of coverage, such as life, health, homeowners, or vehicle insurance.

Subsequently, people should investigate multiple insurers and contrast their policies, concentrating on premiums, deductibles, coverage limits, and policy terms. Consulting consumer testimonials and asking for advice may also offer useful information.

Budget considerations are essential; people must select coverage that maintains sufficient protection alongside reasonable cost. Additionally, knowing the fine print of each policy guarantees that there are fewer unforeseen problems during the claims process. Following these measures, individuals can choose knowledgeably, finding the ideal insurance protection that matches their specific needs and financial goals.

Insurance in the Coming Years: Trends and Innovations

The future of insurance is poised for significant transformation, driven by emerging technologies and changing client demands. Insurers are more and more utilizing artificial intelligence and machine learning to enhance risk assessment and streamline claims processing. These innovations make tailored policies possible tailored to individual needs, cultivating policyholder faithfulness and satisfaction.

Furthermore, the rise of insurtech startups is redefining standard insurance approaches, promoting agility and competitive pricing. Blockchain technology is seeing increased adoption, offering enhanced clarity and security in transactions.

Additionally, as consumers become more aware of the environment, demand for eco-friendly policies is rising. Insurers are innovating to offer coverage that supports eco-friendly practices.

Telematics and wearables are additionally changing health and auto insurance, supplying live metrics that can help calculate premiums precisely. Overall, the insurance landscape is evolving rapidly, focusing on ease, personalization, and sustainability for a new generation of policyholders.

Frequently Asked Questions

What Steps Should I Take After Experiencing a Loss Covered by Insurance?

Following an insured loss, an individual should quickly contact their insurance provider, record the harm, gather necessary evidence, and file a claim, ensuring to keep records of all communications throughout the process.

How Are Insurance Premiums Calculated for Different Individuals?

Insurance premiums are calculated based on factors such as age, health, location, coverage amount, and hazard appraisal. Insurers examine these factors to determine the likelihood of a claim, leading to the determination of fair rates for individuals.

Am I Able to Alter My Insurance Coverage Before Renewal?

Certainly, individuals can typically alter their plan mid-term. Nonetheless, this procedure might differ subject to the insurance provider's provisions, which might impact the coverage, the costs, or demanding payment for charges for revisions performed.

Which Exclusions are Standard in Policy Contracts?

Standard restrictions in coverage agreements include pre-existing conditions, intentional damage, wartime activities, catastrophic events, and certain high-risk activities. Policyholders should carefully review explore here their policies to grasp these restrictions and steer clear of surprising claims refusals.

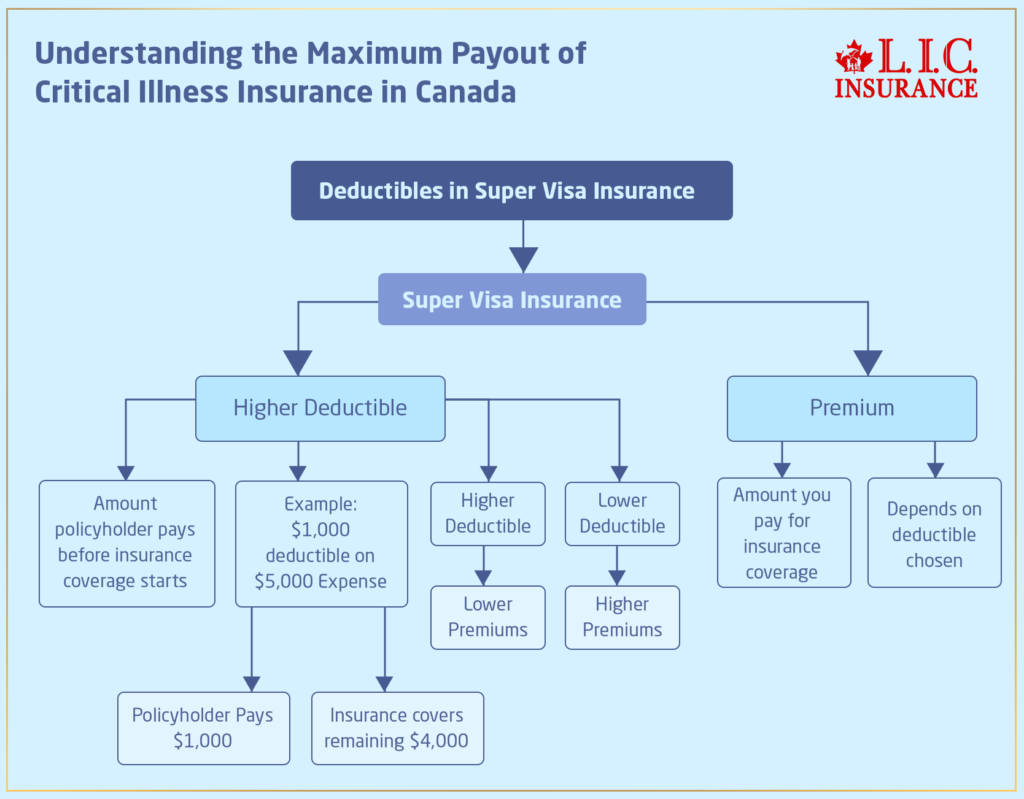

In What Way Do Deductibles Impact The Claims I File?

The deductible amount decreases the copyright's payment sum by mandating that clients pay a specified initial cost before payouts are handled. This heavily influences the overall money recovered, affecting the complete monetary obligation in claim scenarios.